Roth Ira Calculator 2020 Vanguard

You can convert a vanguard traditional ira to a vanguard roth ira in a few easy steps.

Roth ira calculator 2020 vanguard. If you already have a vanguard roth ira. Low contribution limit the annual ira contribution limit for the 2020 tax year is 6 000 for those under the age of 50 or 7 000 for those 50 and older. Your contribution can be reduced or phased out as your magi approaches the upper limits of the applicable phase out ranges listed below. Ira contribution limits deadlines.

Before you get started. Learn more about taxes on roth conversions. Annual ira limits may seem small but combined with tax breaks and compounding your savings can add up significantly over time. Step by step guide with vanguard.

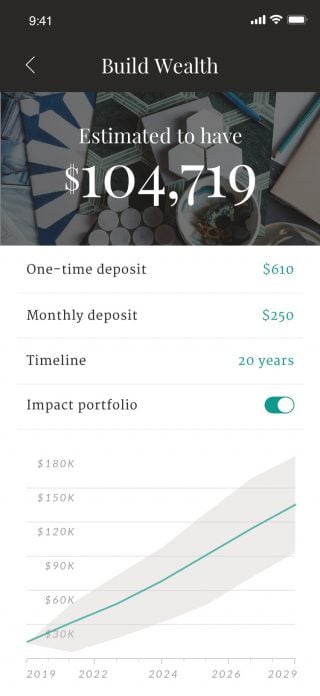

Use the sliders to see how small changes today could affect your financial future. And remember the conversion will be permanent you can t revert the money back to a traditional ira. In comparison the 401 k contribution limit is 19 500 a year. Deciding whether to convert to a roth ira hinges on issues like your tax rate now versus later the tax bill you ll have to pay to convert and your future plans for your estate.

Ira contribution limits for 2020. Saving in a vanguard ira can help you retire on your terms. Money contributed to roth accounts does not result in a tax deduction unlike contributions to tax deferred accounts. Compare what you may have to what you will need.

Are you on track. You can open one online now with as. The figures below are the amounts you can contribute in total across all of your roth and traditional iras including those you hold at other. It s best to talk with a tax advisor before you make your decision.

Both roth and tax deferred accounts benefit from tax free growth unlike a taxable account that is subject to tax drag which can be. Please be aware that you ll owe taxes on any pre tax traditional ira contributions you convert. Whether or not you can make the maximum roth ira contribution for 2020 6 000 annually or 7 000 if you re age 50 or older depends on your tax filing status and your modified adjusted gross income magi. A roth ira is an individual retirement account that offers tax free growth and tax free withdrawals in retirement.

How much income will you need in retirement.